How two companies have shaken up the cannabis industry and excelled in an increasingly crowded market

Nancy Whiteman and Margot Micallef have taken vastly different paths into the cannabis industry with vastly different business models, but both executives have put their respective companies in a position to thrive in the rapidly evolving, ever-expanding world of cannabis.

Whiteman, the CEO and founder of Wana Brands, has been successful with a laser-focused strategy and is expanding her empire into new markets as laws change. In 2018, Wana Brands was No. 1,087 on the Inc. 5000, an annual ranking by Inc. magazine of the fastest-growing private companies.

Micallef is the CEO of Gabriella’s Kitchen, a publicly traded Canadian company that made its name in traditional markets and recently expanded into cannabis, charging headlong into California and the national CBD market. Gabriella’s Kitchen (CSE: GABY) grew revenue by 600% in the past year and is on pace to at least double that in 2019.

What makes these entrepreneurial leaders similar — and sets them apart from the competition — is how they’ve focused on core strengths and traditional business fundamentals to establish their brands as frontrunners in a hyper-competitive industry.

Wana Brands founder and CEO Nancy Whiteman. Photo by Green Earth Photography.

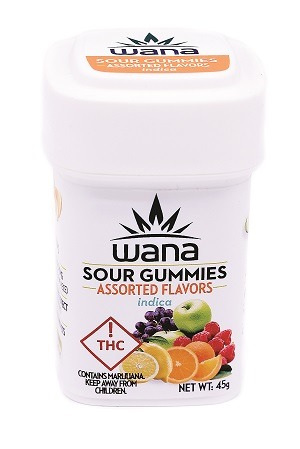

Wana Brands

Nancy Whiteman built Wana Brands into a national powerhouse largely on the popularity of a single product line: cannabis-infused gummies.

“I’d love to tell you that I was brilliant enough to know right off the bat that gummies were going to be the winning category, but that would not be accurate,” she says, laughing.

It might not have been sheer brilliance that led her down the right path, but perhaps she’s just being modest. She was lucky enough to focus on the right category at the right time. She was smart enough to realize the category’s potential. And then she was skilled enough to dominate that category.

As legalization has progressed over the past decade, gummies have solidified their spot as the top-selling edibles category, accounting for about one-third of all edibles sales in the U.S.

“I just did the math on this the other day: Believe it or not, gummies are, by themselves, about 5% of the total cannabis sales in the United States,” Whiteman says.

And when it comes to manufacturing and selling gummies, no company comes close to Wana Brands, which has operations in Arizona, Colorado, Michigan, Nevada, Oregon and Illinois, and is in the process of launching in California, Florida and Ohio. According to BDS Analytics, Wana Brands is the top-selling cannabis brand in the country. The company has a 21% dollar share of the total Colorado edibles market and more than 50% of the state’s gummy market. According to Headset, six of the top 10 edibles in Colorado are Wana Brands gummies, with the Sativa Sour Gummies ranked No. 1. The company also has four of the top 10 edibles in Nevada.

While gummies have been Wana Brands’ signature product, the company has also branched out into other categories, including disposable vape pens.

While gummies have been Wana Brands’ signature product, the company has also branched out into other categories, including disposable vape pens.

Whiteman founded Wana Brands in 2010, just as Colorado was shifting toward a regulated medical marijuana market. At that time, there weren’t analytics companies tracking sales or providing product and consumer data. Market research was all about having boots on the ground: going into dispensaries, talking to budtenders, talking to consumers, paying attention to the popular products and brands.

“You need to be a little bit scrappy,” Whiteman says. “You can’t just sit in your office and theorize about what’s doing well. You have to get out there and look.”

In an industry where so many companies try to produce everything for everyone — flower, concentrates, vapes, every type of infused food imaginable — Whiteman is happy to be an outlier. She decided to specialize, taking a “less is more” approach that allowed her company to get really good at what it does.

The secret to Wana Brands’ success is actually quite simple: “This is a very unsexy thing to say, but I think it starts with product quality and consistency,” Whiteman says. “We’ve spent a lot of time fine-tuning a recipe and making sure it scales consistently. After that, I would say we have a laser-focus on customer service and building partnerships with our dispensary partners.”

The Colorado-based company is most popular in its home state, but as for the future?

“If you ask me where I’m putting my big bets, it’s going to be California,” Whiteman says. “I think California is going to be, by far, the largest cannabis market in the country, and probably the world for the foreseeable future.”

She says the company is in discussions to expand into five or six more states, plus Canada, in the near future.

“Our big momentum right now is our growth out of state,” she says.

GABY

While Wana Brands has been extending its reach and developing its reputation in the cannabis space for nearly a decade, Gabriella’s Kitchen took a more immediate approach, plunging into California’s marijuana market with a series of acquisitions and establishing CBD partnerships to target national, mainstream retail channels.

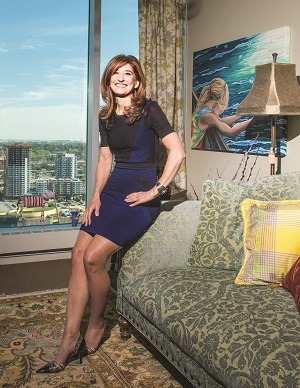

CEO Margot Micallef began to pursue opportunities in cannabis about two years ago, as she realized GABY’s mainstream expertise could elevate the company into a leader in cannabis wellness products. While the cannabis market today is mostly focused on the recreational consumer, Micallef believes the health-and-wellness sector has the most room for growth — and it’s a category in which GABY has already proven to be successful with its line of nutritious, non-infused foods currently sold in more than 3,400 mainstream retailers in the United States.

Gabriella’s Kitchen founder and CEO Margot Micallef.

“The (cannabis) plant and the health attributes fit well with the mission and vision of the company, in terms of using interesting ingredients and innovative ways to make super-charged, healthy food that people could use to enhance the quality of their life,” Micallef says.

To gain a foothold in the exploding California market, she saw two factors being crucial: quality and speed to market.

To accomplish both priorities, Gabriella’s Kitchen in 2018 acquired Sonoma Pacific, a licensed distributor and manufacturing facility that would allow the company to control its own supply chain and utilize the existing infrastructure in California.

“We felt we could amass a sales force organically, but it made more sense to buy a distribution company that already had feet on the street, people with relationships with the dispensaries who could get our product in market quickly,” Micallef says. “We can conceptualize the product, formulate it, extract the oil for it, manufacture it in our facility and distribute it. This also creates an opportunity for us to acquire brands and expedite that process, bring them through the manufacturing facility, enhance formulations and distribute them.”

Sonoma Pacific currently has three brands on the market: Sonoma Pacific is the recreational line, Alto is the wellness line and Aunt Zelda’s is the company’s medicinal brand.

The company also distributes third-party brands, which make up about 35% of Sonoma Pacific’s distribution portfolio — but those third-party brands must fit within the parent company’s imperative on quality.

“We don’t want to do anything to tarnish the Sonoma Pacific brand,” Micallef says, adding that as much as possible, the company works with independent growers in the Sonoma Valley. “We think everybody wins from that perspective.”

The company is also making a national move into the CBD market. Micallef sees the company’s relationships with mainstream retailers as a “launching pad to sell our CBD-infused products.”

In February, Gabriella’s Kitchen announced a joint venture with Eximius Coffee to bring CBD-infused cold brews and coffee pods to retailers across North America. Micallef says independent retailers have jumped quickly into the CBD space. Larger chains are also showing interest, but they’re taking a more cautious approach. Even before the passage of the 2018 Farm Bill, more than $300 million worth of CBD products were sold in the U.S.

“It tells you a lot about how eager the consumer is to move into that space,” she says. “I believe CBD — and in due course, THC as well — is just going to become part of the whole spectrum of products we consume. I believe people will eat it, rub it, drink it, they’ll take bubble baths in it. They’ll use it every which way they can think about using it.”

Looking Forward

Both Wana Brands and Gabriella’s Kitchen continue to expand their presence in their respective markets.

Every time Wana Brands moves into a new area, Whiteman says it has to fine-tune its process to account for differences in elevation and humidity. The company also has to adapt to new packaging and labeling regulations, a never-ending dance to stay compliant in an industry where no two states require the same rules.

“That’s just a cost of being in the business,” she says, adding that she hopes industry standards will emerge someday soon, though she expects state-by-state differences to persist, just as they have with alcohol.

After a rocky year of regulatory shifts, California is finally settling into normalcy and stability, but Micallef sees the state’s industry continuing on a path of consolidation — and with Sonoma Pacific’s infrastructure and ability to support a lot of brands, she expects her company be a consolidator.

“What I have found in this industry,” she says, “is that there are a lot of smaller participants who have good products, but might not have the infrastructure, the capital or the wherewithal to really expand their products.”

No comments: